If you’re running a small online business, your payment gateway isn’t just another checkbox. It’s the backbone of your sales system.

Choose the right one, and you’ll close more deals, build trust, and keep your fees in check. Choose the wrong one, and you risk losing sales, getting slapped with unexpected charges, or worse, looking unprofessional.

Your payment gateway is the front desk of your digital store. It greets your customers, processes their payments, and gives them confidence that your store is safe and trustworthy.

-

A reliable and affordable payment gateway directly impacts your conversion rate and customer trust.

-

Stripe, PayPal, and Square are among the top gateways for small online businesses in 2025, each catering to different needs.

-

Offering multiple payment options like Apple Pay, Buy Now Pay Later, and local methods reduces cart abandonment.

-

Choosing a gateway that integrates smoothly with your platform saves time, prevents technical issues, and improves checkout experience.

-

The best payment gateway is the one that fits your current business needs, supports future growth, and keeps the buying process friction-free.

When that experience goes smoothly, customers come back. When it doesn’t, they bounce before you even know they were there. And once a shopper leaves, they rarely come back to finish the order.

In 2025, with so many people shopping on mobile and expecting frictionless checkouts, choosing a reliable and affordable online payment processor is critical. Most shoppers abandon their carts if they don’t see their preferred payment method.

That means your payment gateway directly affects your conversion rate. I’ve seen small businesses spend hundreds on ads only to lose the sale at checkout because they didn’t offer digital wallets or local payment options. So let’s break it down.

What is a Payment Gateway and How It Works

A payment gateway is the bridge between your online store and your customer’s bank. When someone buys a product, the gateway processes the payment by encrypting data, verifying details with the issuing bank, and transferring the funds into your account. Without it, your customer clicks “buy” and the money has nowhere to go.

Whether you’re selling physical products, subscriptions, or digital downloads, you need a payment gateway that supports secure, real-time transactions. Think of it as the digital cashier that makes sure the money goes where it should.

It handles everything from fraud checks to authorizing payments, all in a matter of seconds. If there’s a hiccup in this step, the entire customer journey falls apart right at the finish line.

Popular examples of payment gateways include Stripe, PayPal, and Square. Some work globally; others are better for local or in-person transactions. Stripe, for instance, is great for tech-heavy stores or SaaS platforms, while Square is perfect for those who also sell in-person at markets or events.

PayPal gives your store instant trust with customers who already have accounts. Understanding the nuances can help you pick one that truly fits your business model.

I’ve helped clients switch from outdated or clunky systems, and the difference in customer satisfaction and sales was immediate.

Key Factors to Consider When Choosing a Payment Gateway

Your payment gateway affects more than just how you get paid. It shapes the buying experience, influences how fast money lands in your bank account, and even determines which tools and platforms you can use to grow your store. Getting this right can save you hours of stress and hundreds of dollars in fees each month.

Transaction fees add up quickly. Some gateways charge a flat rate, others take a percentage, and some do both. Even a 0.5% difference can have a huge impact on your bottom line over time, especially if you’re doing volume.

Platform compatibility is also crucial. If you use Shopify, WooCommerce, Wix, or Squarespace, make sure your gateway integrates smoothly. A poorly integrated gateway can slow down your checkout process and create technical headaches that frustrate both you and your customers.

Then there’s the matter of payment methods supported. Today’s customers expect options—credit cards, Apple Pay, PayPal, and even Buy Now, Pay Later. If they can’t use their preferred method, many won’t hesitate to abandon the cart.

On top of that, security and PCI compliance are non-negotiable. A secure gateway protects both your business and your customers. You’re dealing with sensitive data—one slip-up can damage your brand reputation fast.

Payout speed is another make-or-break factor. Some gateways deposit money in a day, others take a week. That delay can hurt your cash flow, especially if you’re reinvesting revenue into inventory or ad spend.

If you sell internationally, global support becomes essential. You’ll want a gateway that handles currency conversion and international compliance without charging high fees for cross-border payments.

Finally, think about user experience. A clunky checkout experience can turn customers away. Smooth, mobile-friendly checkout flows build trust and reduce cart abandonment. I’ve worked with dozens of clients who didn’t realize their payment gateway was holding them back until they switched.

One of them, who ran a handmade goods store, was losing mobile shoppers due to a confusing checkout page. After switching to Stripe with Apple Pay enabled, their conversion rate jumped by more than 40% in just a few weeks. Sometimes, the smallest friction point in checkout is the biggest reason sales don’t close.

Top 10 Best Payment Gateways for Small Online Businesses in 2025

Finding the right payment gateway can make a real difference in how smoothly your online store runs.

With more customers expecting multiple payment options and faster checkouts, it’s important to know which providers actually deliver, especially when you’re running a small business with limited time and resources.

In this section, we’ll break down ten of the best payment gateways in 2025, based on real experience, practical features, and what actually works for small business owners like you.

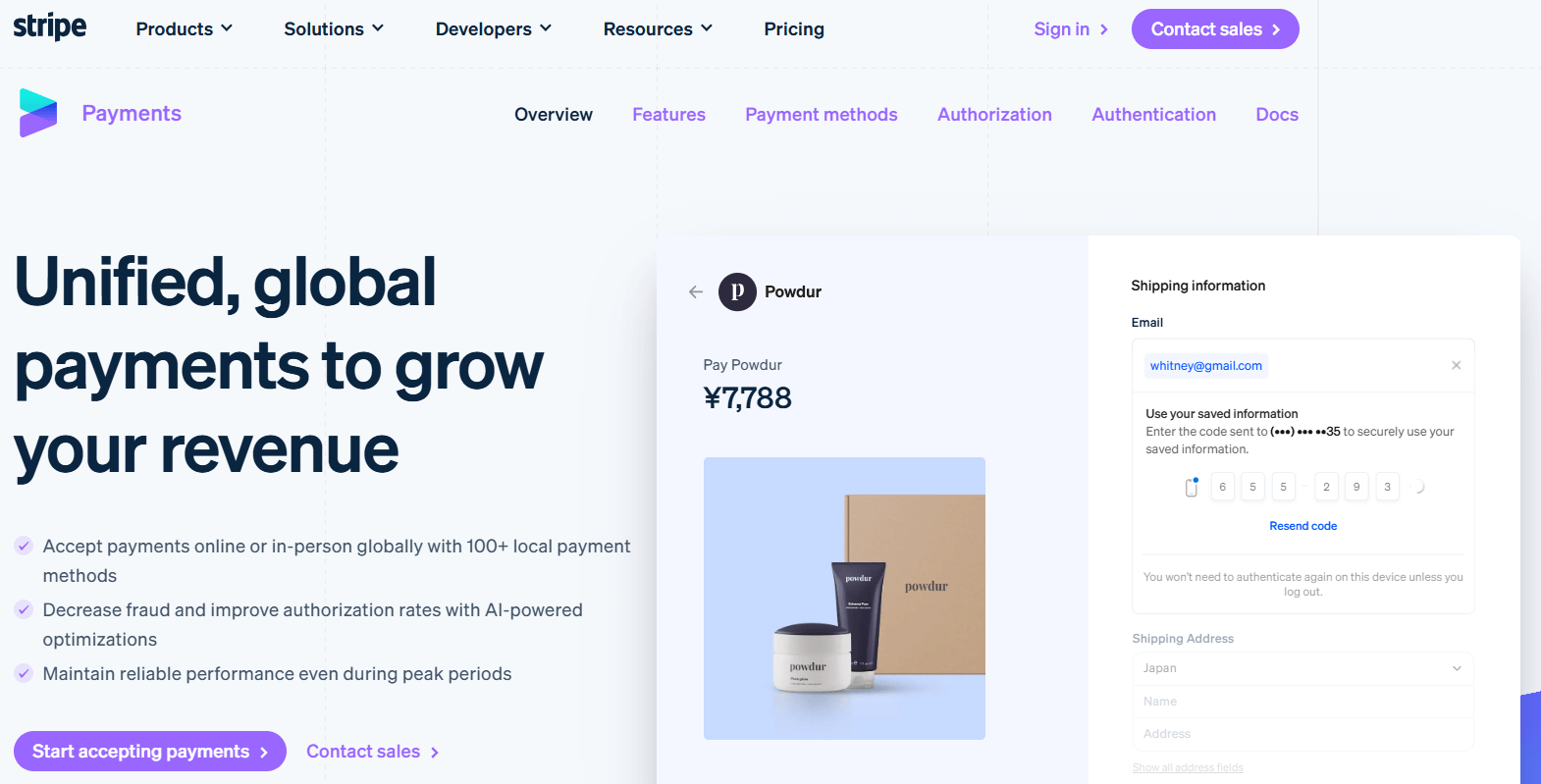

Stripe

Stripe is developer-friendly, scalable, and designed for businesses that need flexibility. It supports everything from one-time purchases to complex subscription models and handles over 135 currencies.

Stripe is a go-to choice for tech-savvy business owners or anyone working with custom websites. It offers transparent pricing (2.9% + 30¢ per transaction) and integrates seamlessly with Shopify, WooCommerce, Wix, and more.

One of my clients who runs a digital product store switched to Stripe and was impressed by how easily it handled recurring billing and checkout flows tailored for mobile users.

PayPal

With over 430 million active accounts, PayPal brings serious trust to the table. Most customers already have an account, which speeds up the checkout process and can lead to higher conversions.

It’s easy to set up, supports international sales, and gives customers flexible options like PayPal Credit and Buy Now, Pay Later.

However, its fees are a bit higher (usually 3.49% + 49¢), and it offers limited customization. Still, it’s one of the most reliable options for marketplaces, digital products, and early-stage businesses looking for credibility fast.

Square

Square shines for businesses that sell both online and in person. If you run a service-based business, like a local bakery or a mobile repair service, Square makes it easy to keep your payments and inventory in one place.

It offers flat-rate pricing (2.6% + 10¢ per transaction), free tools like a drag-and-drop website builder, and built-in POS features. I’ve recommended Square to local sellers who needed a unified system that could handle appointments, tips, and in-store transactions with ease.

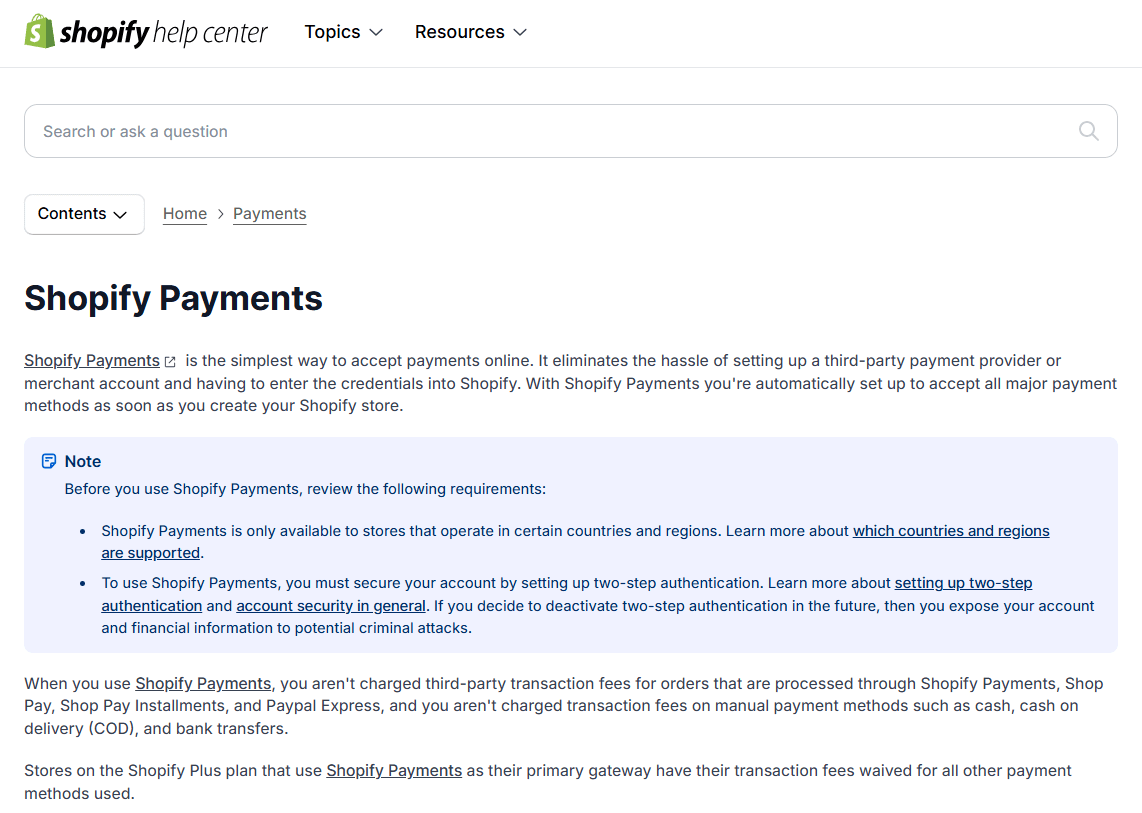

Shopify Payments

If you’re already using Shopify, Shopify Payments is the most straightforward solution. It’s built directly into your store’s backend, so you don’t need to connect a third-party processor.

There are no extra transaction fees on top of your Shopify plan, and it simplifies everything from customer refunds to chargebacks. The only catch? It’s exclusive to Shopify users. But if you’re on that platform, the convenience and tight integration make it worth it.

Authorize.net

Authorize.net, owned by Visa, is a solid choice for established small businesses looking to scale. It supports recurring billing, advanced fraud detection, and even virtual terminals for phone orders.

The downside is the learning curve. There’s a monthly fee plus transaction costs (2.9% + 30¢), and it takes a bit more time to set up. But for high-volume businesses or those who need advanced features, it’s a reliable and secure option.

Wise (formerly TransferWise)

Wise is excellent for international payouts. While it’s not a full checkout system, it’s incredibly useful for sending or receiving payments globally, especially if you’re a freelancer or dropshipper working with international partners.

The platform offers lower currency exchange fees than PayPal, and you get full transparency on conversion rates. I’ve seen clients who sell digital services to overseas buyers save hundreds just by switching their payout system to Wise.

Klarna

Klarna adds serious value if you’re in a niche where cart value matters, like fashion or lifestyle. It lets your customers split payments into installments through Buy Now, Pay Later, which often encourages them to spend more.

Fees vary depending on your location and industry, but Klarna is especially popular with younger shoppers like Gen Z and Millennials. If you’re targeting that demographic, Klarna is worth considering to stay competitive.

Apple Pay / Google Pay

These options are all about speed and convenience, especially for mobile users. Apple Pay and Google Pay don’t charge additional fees beyond your credit card processor and make checkout almost instant.

That’s a big win for mobile conversion rates. The only thing you need is SSL encryption and a compatible browser or device. I’ve seen stores cut their mobile abandonment rate in half just by adding these payment methods.

Braintree

Owned by PayPal, Braintree gives you more flexibility and customization than PayPal’s standard setup. It supports recurring payments, integrates with Venmo, and handles global currencies with ease.

The pricing is transparent (2.9% + 30¢ per transaction), but setup does require some technical knowledge. If you’re a developer or working with one, Braintree gives you more room to tailor the checkout experience without giving up PayPal’s global reach.

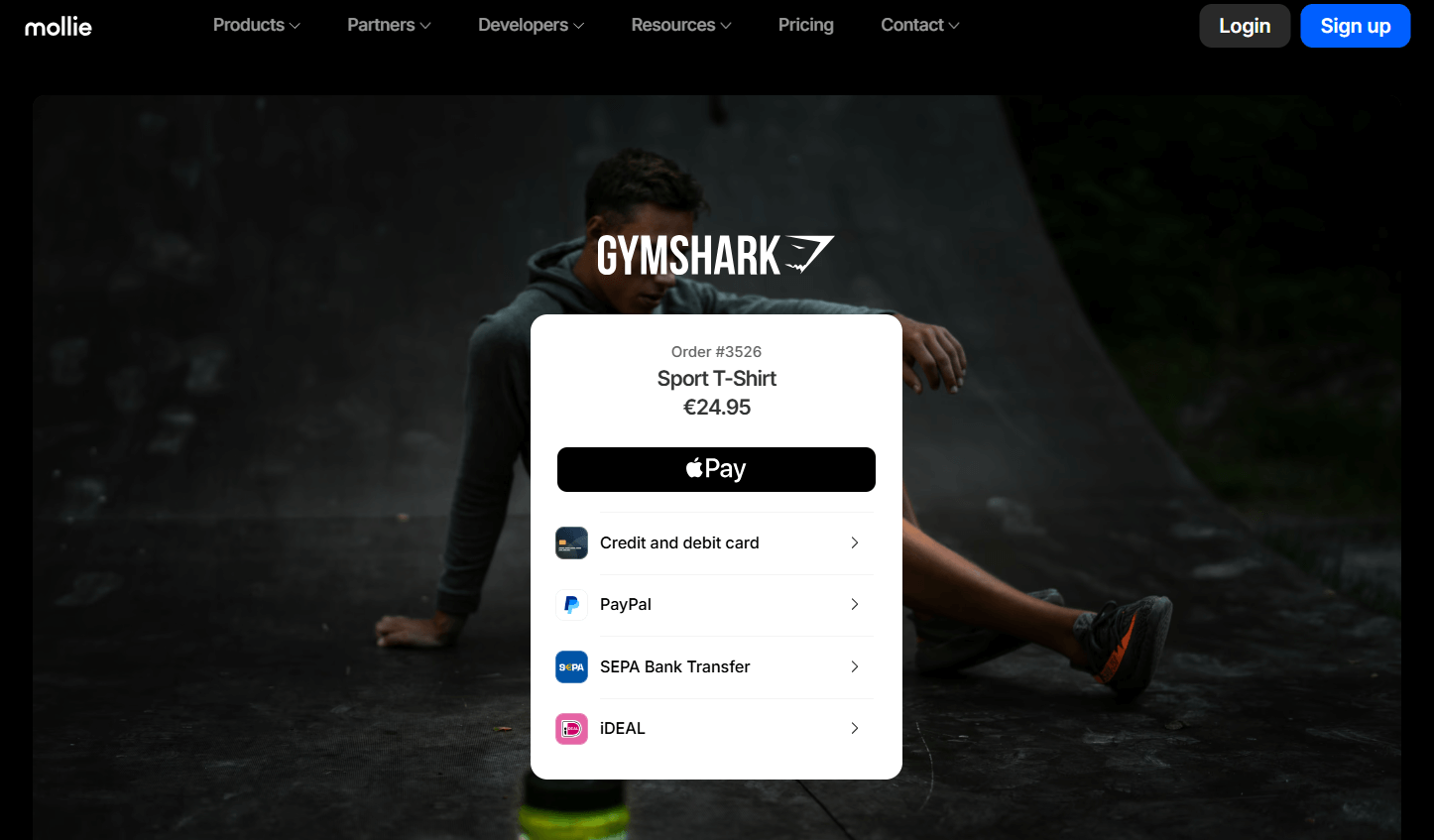

Mollie

Mollie is a rising star in Europe. It supports more than 25 payment methods, from Visa and Mastercard to local options like iDEAL and SEPA. It’s known for its clean user interface, responsive support team, and competitive pay-per-transaction pricing.

There are no monthly fees, which is ideal for small EU-based sellers who need reliable performance without bloated costs. I’ve had clients in the Netherlands and Germany who swear by how smooth their Mollie onboarding experience was.

These ten options aren’t one-size-fits-all. Each offers a different mix of features, flexibility, and pricing that can either support or limit how fast you grow. The key is picking the one that aligns with your audience, your products, and your long-term goals.

Comparison Table: Best Payment Gateways for Small Businesses

To help you make a side-by-side decision, here’s a quick breakdown of how the top payment gateways compare on the things that matter most—fees, ease of integration, global support, and recurring payments.

This table gives you a high-level snapshot of each provider’s strengths so you can match them to your business priorities.

Gateway Fees Best For Global Support Recurring Payments Integration Ease

Stripe 2.9% + 30¢ SaaS, startups, developers Yes Yes Easy

PayPal 3.49% + 49¢ Beginners, digital goods Yes Yes Very Easy

Square 2.6% + 10¢ Local + online businesses US/Canada/AUS Yes Easy

Shopify Pay Based on plan Shopify users Yes Yes Seamless

Authorize.net Monthly + 2.9% Scaling eCommerce Yes Yes Moderate

Wise Low conversion fees Global payouts, freelancers Yes No Moderate

Klarna Varies Fashion/lifestyle retailers Yes Yes Easy

Apple/Google Pay N/A (via gateway) Mobile-first audiences Limited No Moderate

Braintree 2.9% + 30¢ Developers, flexible setups Yes Yes Technical

Mollie ~1.8% (avg) EU small businesses Yes Yes Easy

Most Affordable Payment Gateways for Small Businesses

Affordability goes beyond just transaction fees. When you’re running a small business, every dollar matters, so you want a payment gateway that keeps your costs predictable.

That means looking for one with no monthly fees, clear and transparent pricing, and minimal hidden charges that sneak up on you later. Stripe, Square, and Mollie rank high here, especially for small online sellers trying to keep overhead low without sacrificing performance.

One of my clients had been using Authorize.net for over a year and didn’t realize how much they were spending until we did a fee breakdown.

After switching to Mollie, they saved 24% in transaction costs annually, without giving up the features they relied on, like recurring billing and fraud protection. That extra money went into product packaging and ad spend, which helped boost sales without touching their pricing.

But here’s the catch: affordable doesn’t always mean simple. You need to read the fine print. Watch out for chargeback fees, currency conversion charges, and platform-specific add-ons that can sneak into your bill.

A gateway might look budget-friendly at first glance, but once you factor in cross-border sales or high refund volumes, the real cost becomes clear. Always test and review the full pricing breakdown before committing.

Best Payment Gateways for International Transactions

If you sell globally, you need a gateway that plays well with multiple currencies and complies with international regulations. International sales open the door to massive growth, but they also come with extra layers of complexity—exchange rates, compliance, payout delays, and local payment preferences all factor into the decision.

Wise stands out for low-cost currency conversion. It gives you real exchange rates with no markups, which can make a noticeable difference if you’re dealing with multiple currencies every week.

One of my clients who sells digital services to clients in the UK, Australia, and the US switched to Wise and immediately saw a 30% drop in payout-related costs. They liked knowing exactly what they were being charged, down to the cent.

Stripe and PayPal also offer great international support. Stripe lets you accept payments in over 135 currencies and automatically handles conversions, which is helpful if you’re scaling quickly.

However, PayPal—while convenient and trusted worldwide—tends to charge higher conversion fees, and those extra costs can eat into your margins fast if you’re not keeping an eye on them.

Mollie is excellent if you’re based in the EU, supporting local payment methods like iDEAL, Bancontact, and SEPA.

That level of regional compatibility can make all the difference when selling in places like the Netherlands or Belgium, where customers prefer local gateways over international ones. If your audience is mostly in Europe, Mollie makes checkout feel local, even if your store isn’t.

How to Integrate a Payment Gateway into Your Online Store

Integration depends on your platform, but most major platforms have built-in or plugin-based options that make setup surprisingly quick, if you know where to look. You don’t need to be a developer to get it right, but you do need to follow each step carefully so nothing breaks when people are ready to buy.

On Shopify, integration is about as smooth as it gets. You can enable Shopify Payments directly from your dashboard or connect third-party options like Stripe or PayPal in just a few clicks through the payment settings. WooCommerce also makes it easy with free official plugins for Stripe, PayPal, and Square. I’ve helped clients set these up in under 15 minutes, with no coding required. Wix and Squarespace offer similar simplicity, usually through one-click connections or drop-down menu selections that let you activate a gateway almost instantly.

The key step most sellers overlook is testing. Don’t stop at installation—run a test transaction and go through the checkout process like a real customer. A broken payment flow is like having your cashier take a lunch break right when customers are lining up.

I once worked with a store that unknowingly had a PayPal integration issue that blocked mobile checkouts for weeks. Fixing it took minutes, but the lost revenue? That hurt. Always test and confirm that your setup works across both desktop and mobile devices before launching or relaunching your store.

Final Tips for Choosing the Right Payment Gateway

You don’t need the fanciest features. You need what fits your business now, with room to grow. A lot of sellers waste time comparing advanced tools they won’t even use, while missing out on what actually matters—stable performance, ease of setup, and reliable customer support.

Pick a gateway that gives your customers the flexibility they expect, without draining your profits or making checkout complicated. Whether it’s Apple Pay, PayPal, or local payment options, offering multiple ways to pay makes people feel like you’re speaking their language.

A clean, secure, mobile-optimized checkout builds trust faster than any ad campaign. People won’t remember your branding if they can’t even make it through checkout without errors. Keep your eyes on what matters: trust, speed, cost, and flexibility.

If you’re ever stuck choosing, drop your store type in the comments, and I’ll share what worked for similar businesses I’ve helped. I’ve worked with fashion brands, handmade goods sellers, subscription services, and more, and in each case, the best gateway was the one that balanced simplicity with scalability. There’s no one-size-fits-all answer, but there’s always a best fit for where you are right now.

If I had to pick one gateway for most small online businesses in 2025, it’d be Stripe. It’s flexible, fairly priced, developer-friendly, and widely supported. It works well whether you’re selling digital courses, running a monthly subscription, or launching a DTC brand.

For Shopify users, Shopify Payments simplifies your life by eliminating extra fees and syncing smoothly with the platform. For sellers in the EU, Mollie is a strong contender—it’s lightweight, localized, and reliable for cross-border sales.

But don’t make this choice in a vacuum. Consider your product type, your audience, and how tech-savvy you are. The more aligned your payment system is with how your customers shop, the more sales you’ll close.

I’ve seen businesses double their revenue just by switching to a gateway that offered smoother mobile payments. The “best” payment gateway is the one that removes friction and gets you paid, without making your customers hesitate at checkout.