In early February, President Donald Trump issued an executive order imposing a 10% tariff on Chinese imports and suspending the “de minimis” rule, which had previously allowed duty-free entry for packages valued under $800 from China.

This abrupt policy change led to significant disruptions in international shipping and customs processes. It particularly affected Chinese e-commerce platforms like Shein and Temu, which had leveraged this rule to ship low-cost goods directly to US consumers without incurring tariffs.

In response to the new regulations, these companies began adjusting their strategies. Shein started fulfilling orders from US-based warehouses, while Temu increased its focus on promoting “local” products stored in US warehouses to mitigate potential delays and additional costs.

The US Postal Service (USPS) initially halted the acceptance of packages from China and Hong Kong following the EO, citing the need to adapt to the new tariff requirements.

-

The suspension of the de minimis rule for China and the 10% tariff on Chinese imports are disrupting ecommerce, leading to higher costs and shipping delays.

-

Shein and Temu are adapting by storing inventory in US warehouses, a strategy smaller sellers may need to consider to avoid customs delays.

-

Small online sellers face tough choices—raise prices, absorb costs, or find alternative suppliers in countries like Vietnam, India, or Mexico.

-

The US trade policy shift aims to boost domestic manufacturing, but it may also hurt low-income shoppers and small businesses relying on cheap imports.

-

Success depends on adaptability—sellers must diversify suppliers, optimize fulfillment strategies, and rethink pricing to stay competitive in the new landscape.

However, this decision was quickly reversed, and USPS resumed accepting these packages after announcing plans to collaborate with US Customs and Border Protection to implement the new tariffs without causing significant delivery disruptions.

As of today, the de minimis exemption for Chinese imports remains suspended, and the 10% tariff on Chinese goods is in effect. Businesses and consumers are advised to stay informed about these changes, as they may lead to increased prices and longer shipping times for goods imported from China.

What Is the De Minimis Rule, and Why Does It Exist?

The de minimis rule is a trade policy that allows goods valued below a certain threshold to enter a country without being subject to duties or extensive customs processing.

In the US, this threshold is set at $800, meaning any package valued at or below this amount can enter the country duty-free and with minimal regulatory oversight.

The rule exists to simplify trade, reduce customs bottlenecks, and allow consumers and businesses to receive low-value shipments quickly and without extra costs.

The main reason behind the de minimis exemption is efficiency. Processing millions of low-value shipments individually for customs duties and taxes would be a logistical nightmare, overwhelming customs agencies and slowing down trade.

By setting a reasonable threshold, the government can focus its resources on higher-value imports while allowing e-commerce and global trade to flow more smoothly.

For decades, this rule was a benefit to American consumers and small businesses, particularly in the age of e-commerce. Retailers, dropshippers, and independent online sellers could source inexpensive goods from overseas, particularly from manufacturers in China, and have them delivered directly to US buyers without the added costs of duties and taxes.

This model became the backbone of fast-growing platforms like Shein, Temu, and AliExpress, allowing them to sell ultra-cheap products while keeping shipping costs low.

According to a report by the House of Representatives, Shein and Temu likely account for more than 30% of all de minimis shipments into the US, highlighting the scale at which these platforms utilize the exemption.

However, the rule also created controversy, especially as Chinese sellers began dominating the direct-to-consumer market. Critics argued that it gave foreign sellers, particularly those in China, an unfair advantage over US-based retailers, who had to deal with import taxes, sales tax collection, and stricter regulations.

Many US manufacturers and lawmakers pushed back, claiming that the de minimis rule was being exploited—allowing massive volumes of untaxed, foreign-made products to flood the market and undercut American businesses.

Some also raised concerns about product safety, counterfeits, and forced labor violations, since packages entering under the de minimis threshold were often subject to less scrutiny compared to higher-value imports.

This led to growing pressure on policymakers to rein in the rule, particularly as tensions between the US and China escalated. The suspension of the de minimis exemption for Chinese imports is a direct response to these concerns, aimed at leveling the playing field for US businesses and ensuring that Chinese sellers aren’t bypassing tariffs and regulations.

However, for consumers and small sellers who rely on Chinese suppliers, this shift could mean higher prices, longer shipping times, and more complicated logistics moving forward.

Is Trump’s Decision to Suspend De Minimis for China Good or Bad for the Economy?

The decision to suspend de minimis for China is a double-edged sword, with both positive and negative economic consequences, depending on which side of the debate you’re on.

From a US manufacturing and retail perspective, this move is seen as a win. For years, American businesses have struggled to compete with Chinese e-commerce giants that could sell cheap goods while avoiding import taxes.

By closing this loophole, US manufacturers and retailers may finally compete on fairer terms. With Chinese sellers now subject to tariffs, more consumers and businesses may turn to domestic suppliers, potentially boosting local manufacturing, increasing demand for American-made goods, and preserving jobs.

From a trade policy standpoint, this decision also aligns with efforts to reduce dependence on China. Policymakers argue that relying too much on Chinese imports—especially in key industries—is a national security risk. Closing the de minimis loophole signals a push for more domestic production and trade partnerships with allied countries.

However, the change isn’t without downsides, particularly for consumers and small businesses that rely on Chinese imports. Shoppers on platforms like Shein, Temu, and AliExpress will face higher prices and fewer budget-friendly options.

While critics claim cheap Chinese goods hurt US businesses, many lower-income Americans have depended on them for affordable products. With a new 10% tariff and stricter customs rules, prices will rise, potentially contributing to inflation.

For small online sellers, this is especially concerning. Many rely on Chinese suppliers for low-cost inventory, whether through dropshipping, wholesale, or private labeling. Now, they face tough choices: raise prices and risk losing customers, absorb the costs and shrink their profits, or find alternative suppliers—many of which may not be as affordable.

For smaller businesses, shifting production to the US or other countries isn’t always practical due to higher costs and supply chain complexities.

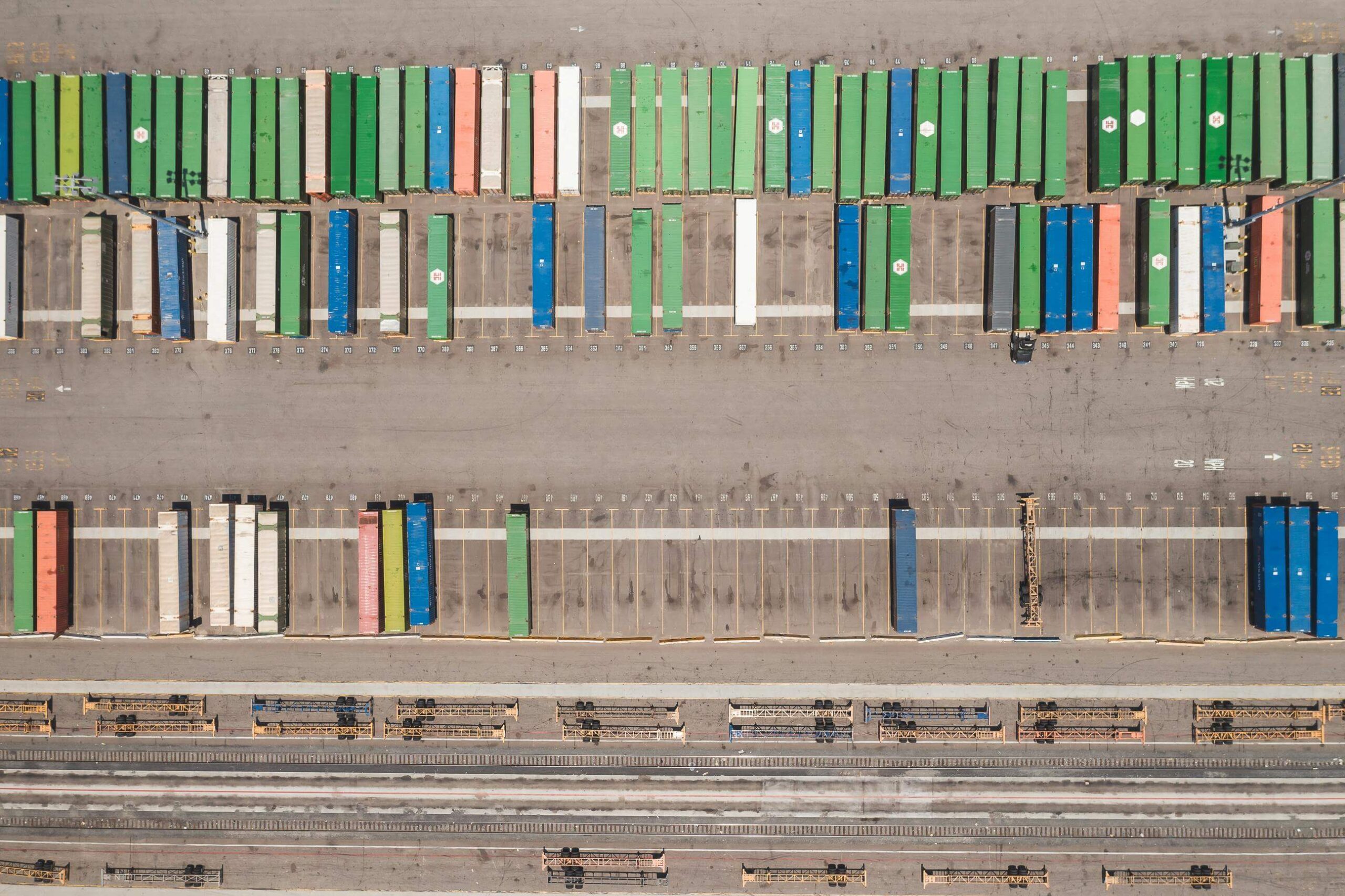

Beyond e-commerce, logistics and shipping industries may also feel the strain. US Customs and Border Protection now has to process a higher volume of shipments that previously cleared under de minimis, which could lead to delays at ports and increased administrative burdens.

While USPS has resumed accepting packages from China, ensuring a smooth implementation of the new tariff system without disrupting delivery times remains a challenge.

In the long run, the success of this policy will depend on whether it genuinely helps US businesses without severely harming consumers and small sellers. If it leads to increased domestic production and job creation, it could be considered a smart economic move.

However, if higher costs and supply chain disruptions take a heavy toll on small businesses and lower-income shoppers, it could backfire, leading to frustration and possible policy reversals.

For now, the suspension of de minimis marks a major shift in US-China trade relations, with both winners and losers. Whether it strengthens the US economy or simply reshuffles trade challenges remains to be seen.

How Will This Affect Small Online Sellers in the US?

Costs will rise, and supply chain disruptions are likely, but how you adapt will determine your long-term success. Pricing is the most immediate challenge. With a 10% tariff on Chinese imports, those once-affordable wholesale prices are getting more expensive.

Dropshippers and Amazon FBA sellers, who operate on thin margins, will feel this the most. Even a slight price hike can drive customers to competitors. According to Jungle Scout, 70% of consumers shop online seeking lower prices, and 46% have abandoned their carts due to unexpected costs.

Dropshippers are in an especially tough spot. The model relies on cheap sourcing and thin margins. With costs rising, many may struggle to compete with larger brands that can afford bulk pricing and domestic fulfillment.

If you’re a dropshipper, it’s time to rethink your supplier strategy, whether by looking for alternatives outside China (which isn’t always easy) or switching to domestic inventory to avoid high tariffs and long shipping delays.

According to MetaPack’s 2016 State of eCommerce Delivery Consumer Research Report, 45% of respondents abandoned online shopping baskets due to unsatisfactory delivery options, with slow delivery speed or lack of flexibility being the top reasons.

If your business depends on fast, international shipping at low rates, you’ll need a backup plan—fast.

Competition is another issue. While this policy was meant to help US businesses, big retailers and brands with US warehouses will have an easier time adapting than small independent sellers.

Companies like Amazon, Walmart, and Target can absorb tariff costs and adjust their fulfillment strategies. But a solo entrepreneur selling handmade or imported goods on Etsy or Shopify? Not so much.

Still, there’s opportunity for those who pivot quickly. You may explore domestic suppliers or alternative sourcing countries like Vietnam, India, or Mexico.

The Boston Consulting Group reported in 2024 that Mexico has overtaken China as the largest US trade partner, driven by exports of manufactured goods and a surge in foreign investment in new factories. If that trend continues, more affordable, tariff-free options could emerge.

However, switching suppliers isn’t as simple as flipping a switch. If you’ve spent years working with a Chinese manufacturer, moving production elsewhere means renegotiating contracts, ensuring product quality, and possibly paying higher prices for raw materials and labor.

If you sell private-label products, rebranding and adjusting your supply chain could take months.

In the short term, small online sellers will likely deal with higher costs, longer shipping times, and increased competition from bigger players. But those who find alternative suppliers, shift to domestic warehousing, or rethink their product offerings could turn this into an opportunity.

At the end of the day, sellers like you and me need to adapt. Sticking to old sourcing and fulfillment strategies is no longer an option.

How Can Online Sellers Prepare for the Fallout?

To survive the suspension of the de minimis rule for China, you need to rethink your sourcing, pricing, and logistics strategies before rising costs and slower shipping times take a toll. Simply hoping things will return to normal isn’t a strategy—businesses that adapt quickly will have the best chance of staying competitive.

If you heavily rely on Chinese suppliers, now is the time to diversify sourcing. As explained above, countries like Vietnam, India, and Mexico are becoming stronger manufacturing hubs.

Shifting suppliers isn’t always simple, though. It takes time to establish trust, ensure quality, and negotiate pricing. If sticking with Chinese suppliers is necessary, one workaround is to use suppliers with US warehouses.

Shein, Temu, and other large ecommerce platforms are already doing this, and some manufacturers are open to stocking inventory in third-party US fulfillment centers, reducing customs delays and keeping shipping times competitive.

Another strategy is importing in bulk instead of relying on individual shipments. The days of cheap, duty-free packages from China are over, so sellers who order in bulk can negotiate better freight rates and minimize tax burdens.

However, bulk buying means paying upfront for inventory, so careful sales analysis is crucial to avoid overstocking slow-moving products.

When it comes to pricing, experiment with methods like bundling. Instead of simply marking up prices, bundle products to increase perceived value. For instance, you can pair a phone case with a screen protector instead of selling them separately.

Brand differentiation is another key to staying profitable. Generic, easily replaceable products will suffer the most under these new tariffs. If you’re selling the same thing as ten other competitors, customers will choose the lowest price.

Instead, invest in branding, packaging, and unique product features to stand out. A strong brand allows you to charge higher prices without scaring away customers.

Logistics is another area where you need to adapt. If you rely on direct shipping from China, you may see more customer complaints, chargebacks, and refunds due to longer wait times.

Can you afford to store inventory in the US? Then, consider using third-party logistics (3PL) providers like ShipMonk, Flexport, or Easyship. These services store inventory closer to target markets, cutting down on transit delays.

Customer communication will also play a huge role in managing expectations. If your customers expect 2-week shipping times but experience 4-week delays, they’re going to get frustrated. Update your shipping estimates, send order progress emails, and offer small discounts for longer wait times to maintain trust.

At the end of the day, the suspension of de minimis for China isn’t the end—it’s just a shift in how sellers need to operate. Those who diversify suppliers, optimize logistics, and rethink pricing strategies will stay ahead, while those who resist change will struggle.

I’ve seen the ecommerce landscape evolve many times, and one thing is always true: Adaptability wins. This isn’t the first trade disruption, and it won’t be the last. But smart sellers will find a way to turn this challenge into an opportunity.